BLOG

Make 2023 Annual Exclusion Gifts by Dec. 31

One of the most effective estate-tax-saving techniques is also one of the simplest: making use of the gift tax annual exclusion. It allows you to give to an unlimited number of family or friends cash or property valued up to a “specified” amount each year without...

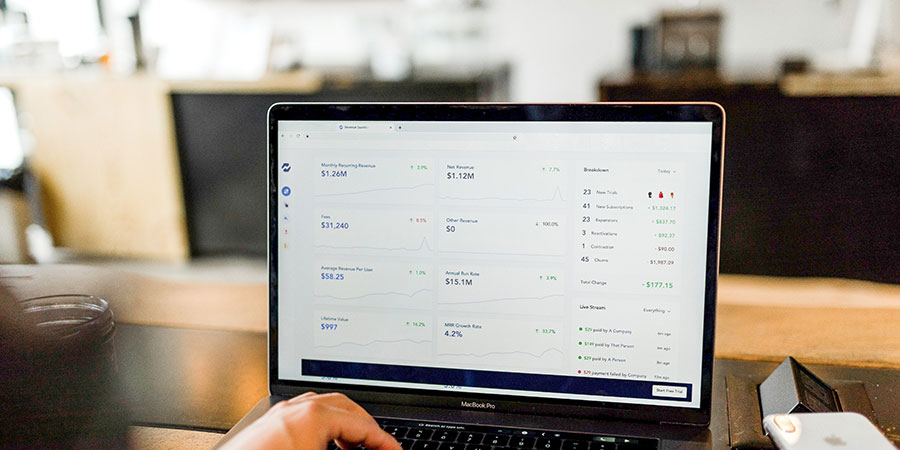

How QuickBooks Can Improve Your Chances of Budget Success

Budgets are hard to maintain through the best of times let alone over the last few years. First there was COVID. Then supply chain issues. Then a significant rise in inflation. If you've been trying to stick to a budget, you've probably been struggling. The biggest...

How To Be Ready To Secure a Business Bad Debt Deduction on Your 2023 Tax Return

Is your business having trouble collecting payments from clients or vendors? You might be able to claim a bad debt deduction on your tax return. But if you hope to take the deduction on your 2023 return, you'll have to get busy, because you must be able to show that...

New Per Diem Rates for Business Travel

The IRS has announced the per diem rates for ordinary and necessary business travel expenses in fiscal year 2023-24: When using the high-low substantiation method, the rate for travel to high-cost localities is $309 per day and the rate for all other continental...

Is Disability Income Taxable?

If you may be eligible for disability income should you become disabled, it's important to know whether that income will be taxable. As is often the case with tax questions, the answer is “it depends.” Key Factor The key factor is who paid it. If your employer will...

One-Time Thing: IRA to HSA transfer

Did you know that you can transfer funds directly from your IRA to a Health Savings Account (HSA) without taxes or penalties? Under current law, you're permitted to make one such “qualified HSA funding distribution” during your lifetime. Typically, if you have an IRA...

Follow IRS Rules to Nail Down a Charitable Tax Deduction

Donating cash and property to your favorite charity is beneficial to the charity, but also to you in the form of a tax deduction if you itemize. However, to be deductible, your donation must meet certain IRS criteria. First, the charity you're donating to must be a...

Withdrawing ERC Claims

Recently, the IRS halted processing of claims for the Employee Retention Credit (ERC), due to a high volume of fraudulent claims. The moratorium is through at least the end of 2023. ERC claims that were already filed are now subject to longer processing, including...

Do You Sell Products? How QuickBooks Can Help You Track Them

If your business sells products, you know how important it is to be able to track their numbers precisely. Keep your stock at the right levels, and you shouldn't run out of items. You also won't have a lot of money tied up in products that aren't selling. You probably...

Buy-Sell agreements Require Careful Planning

Does your business have multiple owners? If so, you need a buy-sell agreement. This type of binding contract determines how (and at what price) ownership shares of a privately held business will change hands should an owner depart. There are also potential tax...