January is tough. The holidays are over. Tax forms are starting to trickle in. You probably have a lot of things on your to-do list that you didn’t get done in December because you were so busy. Now you don’t know when you’ll have time to catch up because the new month and new year bring their own set of fresh responsibilities.

You probably did the accounting work that you had to in December, but you may not feel like you’re starting with a clean slate this month.

QuickBooks makes it so much easier to clean up your finances than doing your accounting manually. Consider taking these five suggestions to jump start 2024.

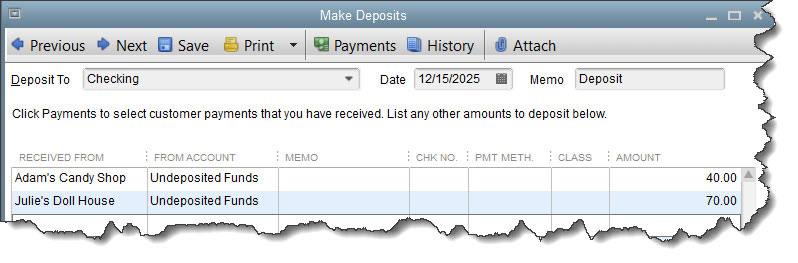

1. Check If You Need to Deposit Payments

Before you try to determine who owes you money, make sure that you don’t have funds sitting in QuickBooks that should be deposited in a bank account. Click Record Deposits on the homepage. The Payments to Deposit window will open, displaying a list of payments received that haven’t yet been deposited in your bank account. Select the ones you want to deposit and click OK to open the Make Deposits window. Make sure to select the correct Deposit To account and specify if you want cash back at the bottom of the screen. Save the transaction.

2. Run These Five Critical Reports

It’s easy for you, customers and vendors to miss invoices and bills in December. So start 2024 by finding out where you stand on both. These four critical A/R and A/P reports will tell you a lot in a hurry. If you sell products, also check in on your inventory status.

Open the Reports menu to find and create these reports:

- A/R Aging Detail. Which of your customers are behind in paying invoices and statements you’ve sent? How much do they owe, and how late are they?

- Open Invoices. Just what it sounds like: a list of open invoices and their due dates

- A/P Aging Detail. Which of your bills are due and overdue?

- Unpaid Bills Detail. How much do you owe each vendor? Are any payments overdue?

- Inventory Stock Status by Item. This report shows a lot of detail about your stock status, with columns for reorder point, on hand, on PO, sales/week, etc.

TIP: QuickBooks has a special report for collections. Open the Reports menu and click Customers & Receivables | Collections Report. This shows which customers are overdue, how much they owe, and what their phone numbers are.

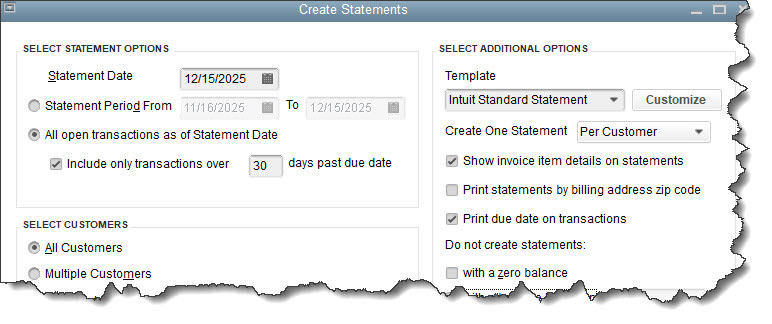

3. Send Statements

Sometimes your customers just forget to pay their bills. Or your invoices got caught up in the end-of-year paper blizzard. Or someone simply didn’t get an invoice. You could just send another invoice. It might be more effective, though, to send statements. These forms display lists of financial activity between you and the customers over a specified period of time. Open the Customers menu and select Create Statements.

4. Check Your Purchase Order Status

Are any of your vendors behind in filling purchase orders? You don’t want to find yourself running out of inventory because an expected shipment didn’t arrive. Run the Open Purchase Orders Detail report. Follow up on any back orders that haven’t been filled yet and ensure that delivery dates have been met.

5. Consider Setting Up Online Financial Connections

If you’re already well-acquainted with the Bank Feeds Center in QuickBooks, you know how online financial connections provide real-time information about your bank accounts. You can download transactions into QuickBooks so you know on a daily basis which ones have cleared.

Creating a QuickBooks Payments account and accepting credit card and bank payments from customers helps you get paid faster.

Make It a Good Year

We’re hoping that 2024 is a productive, profitable year for you. QuickBooks can help in so many ways – as long as you’re diligent about updating it regularly and understanding how it works. Please contact the office if you want to expand your use of the software, or if you simply need to learn how unfamiliar features work.